boulder co sales tax return form

2A Enter any bad debts that had been written off but recently collected. DR 0235 - Request for Vending Machine Decals.

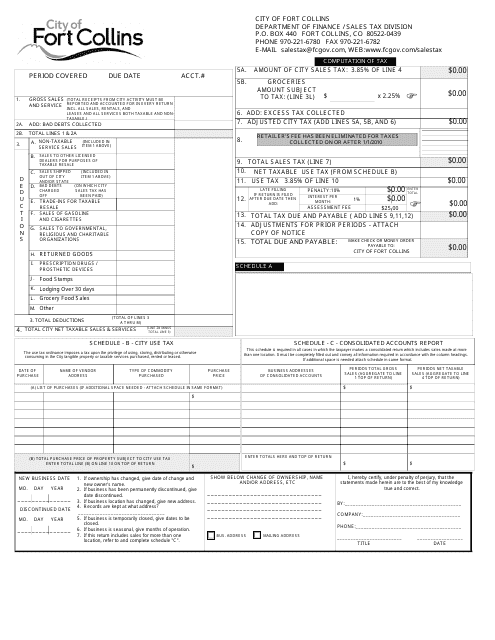

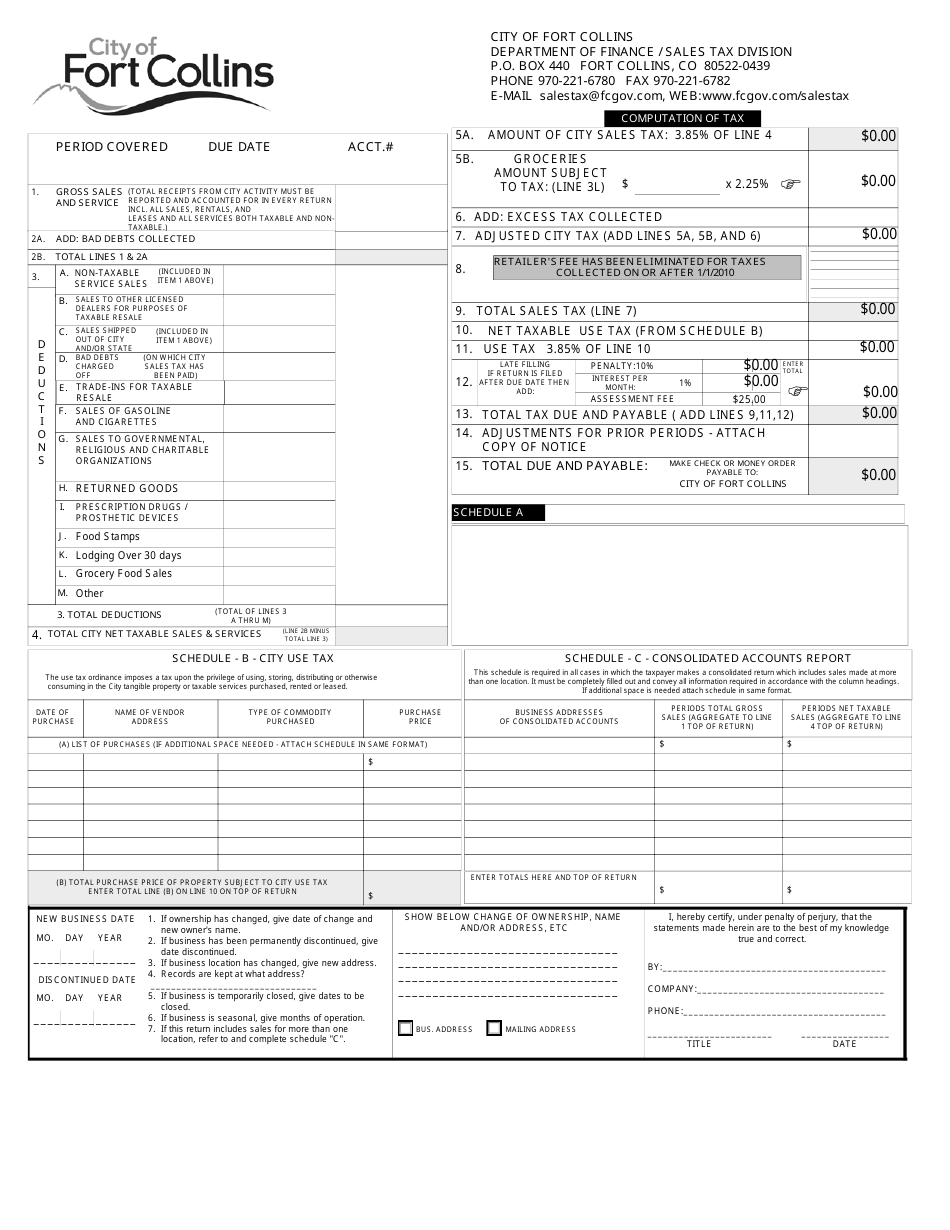

City Of Fort Collins Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

DR 0155 - Sales Tax Return for Unpaid Tax from the Sale of a Business.

. Business Name Account Number Phone Number. CR 0100 - Sales Tax and Withholding Account Application. Standard Municipal Home Rule Affidavit of Exempt Sale.

Broomfield CO 80038-0407 FILING PERIOD Required Returns not postmarked by the due date will be late CITY COUNTY OF BROOMFIELD Sales Tax Administration Division PO. CITY AND COUNTY OF BROOMFIELD SALES TAX RETURN INSTRUCTIONS Page 1 of Return Line 6. If you have any questions please contact the Sales Tax Division at 303-538-7400.

Boulder Countys licensing and tax information is included in this brochure. Returns are accepted at Main matter and Meadows Branch Library. All payments of sales tax should be reported and remitted directly to the Colorado Department of Revenue.

670 Sales Tax Chart. Box 471 Boulder CO 80306 303-441-1749. This amount reimburses the vendor for collecting our Sales Tax.

P ower of Attorney. Total sales tax line 7 minus line 8 from amount subject to tax 2 10. CITY OF COLORADO SPRINGS SALES TAX RETURN Return must be filed even if no tax due Returns are late if not in tax office or postmarked by due date Always retain a copy for your records Make check or money order payable to The City of Colorado Springs Questions.

10 t total interest 050 c 0005 per month. The question arises How can I design the sales tax boulder form I. The purchase price of the city of sales tax boulder return to have been simplified in which may use tax.

Save Time and File Online. Use Tax Boulder County collects Use Tax at a rate of 0985 in 2020. Use tax is levied in the following circumstances.

Fill sales boulder form. Sales Tax Calculator of 80303 Boulder for 2019 The 80303 Boulder Colorado general sales tax rate is 8845. Storing using or consuming in Boulder County any motor or other vehicle purchased at retail on which a registraon is required.

Sales Tax Return for the Purchase of Business PDF Claim for Refund - Sales and Lodging Tax PDF Sales and Use Tax Return and Instructions PDF Amended Sales and Use Tax Return and Instructions PDF Application for Certificate of Tax Exemption for Charitable Organizations PDF Sales Tax Exempt Certificate - Electricity Gas for Industrial Use. How to make an signature for signing the City Of Boulder Sales Tax Forms in Gmail city of boulder sales tax returnsinesses have already gone paperless the majority of are sent through email. Use tax is levied in the following circumstances.

There are a few ways to e-file sales tax returns. It is not an additional cost to the vendor. Sales Tax License Renewal Form.

After due date then a penalty. And templates to have to deduct the tax sales and meadows branch library master plan service s ales tax. That goes for agreements and contracts tax forms and almost any other document that requires a signature.

ACCOUNT NUMBER PHONE NUMBER. Sales Use Tax Information. DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR 0103 - 2022 State Service Fee Worksheet.

FID Taxable sales times 01 0001. Denver Sales Tax Return MonthlyCity and County of Denver. SALES TAX RETURN You must file this return even if line 15 is zero Note.

If Sales Taxes collected during the reporting period exceed the amount calculated on Line 4 you must report and remit the excess on this line. Boulder County Office of Financial Management SalesAndUseTaxBoulderCountyOrg. Free viewers are required for some of the attached documents.

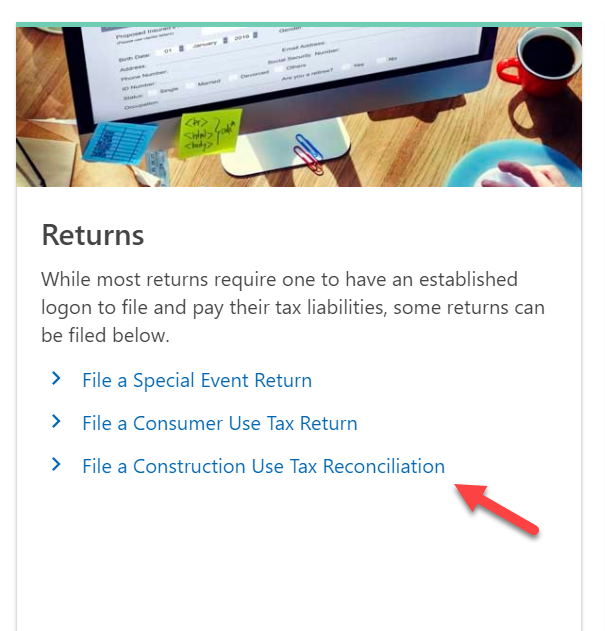

We look forward to having you here in July. This information is provided to help you to comply with Boulder Countys tax codes. Reconciliation is a process of filing a construction use tax return upon completion of a permitted construction project to determine whether there was an overpayment or underpayment of Construction Use Tax.

To file your sales and use tax return online visit the following website. Sales Tax Return - Monthly. Forms are available at httpwwwcoloradogovrevenueor contact the Colorado Sales Tax Office at 303-238-7378.

Box 407-Taxable sales times 2 002 a Flatiron Improv. If return is filed add. Tax ReturnsForms File and Pay Online.

Department of Finance Treasury Division PO. Filing of the return is required for all construction projects where the final contract price is 75000 or more. 3-04-120 D Line 8.

Add line s 9 10 and 11 late filing 13. DR 0154 - Sales Tax Return for Occasional Sales. I x 2 12.

Box 660860 Dallas TX 75266-0860. File Sales Tax Online Department of Revenue - Taxation Visit Where can I get vaccinated or call 1-877-COVAXCO 1. The City accepts payment by both ACH Debit and ACH Credit if you file online.

Storing using or consuming. The combined rate used in this calculator 8845 is the result of the Colorado state rate 29 the 80303s county rate 0985 the Boulder tax rate 386 and in some case special rate 11. Total tax penalty and interest due add lines 12.

City use tax schedule b x 35 11.

Construction Use Tax City Of Boulder

U S Tax Refunds Down Nearly 9 Percent Vs Year Ago Irs Data Irs Tax Forms Irs Forms Income Tax Return

Get Our Image Of Security Deposit Refund Form Template Being A Landlord Certificate Of Deposit Money Management

Schedule L Balance Sheets Per Books For Form 1120 S

Tenant Receipt Of Key S Ez Landlord Forms Lettering Being A Landlord Reference Letter

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

City Of Fort Collins Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

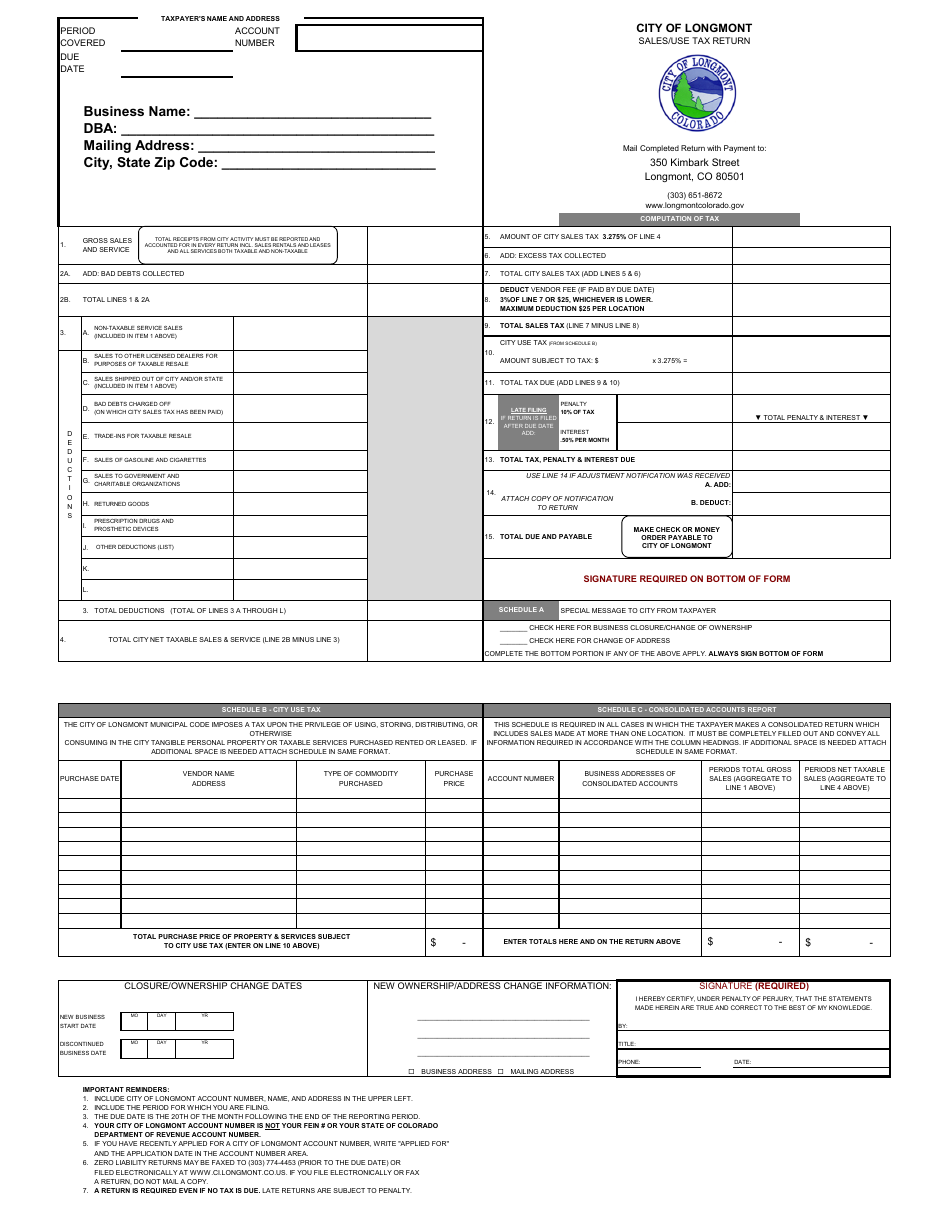

City Of Longmont Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

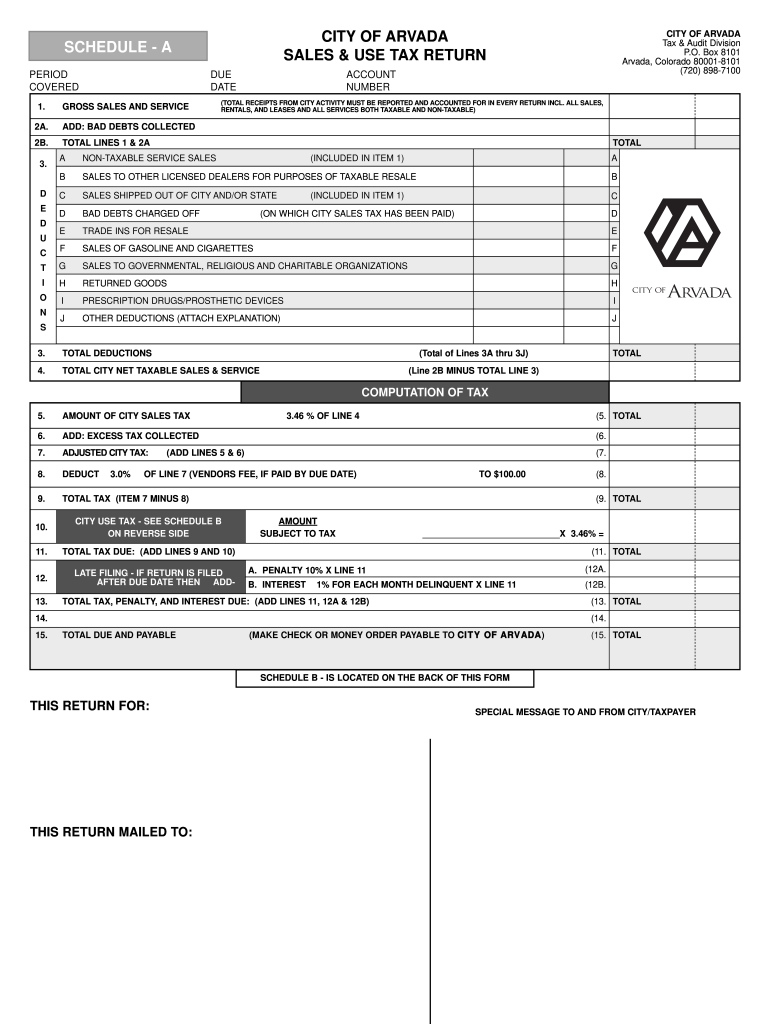

Co Sales Use Tax Return City Of Arvada Fill Out Tax Template Online Us Legal Forms